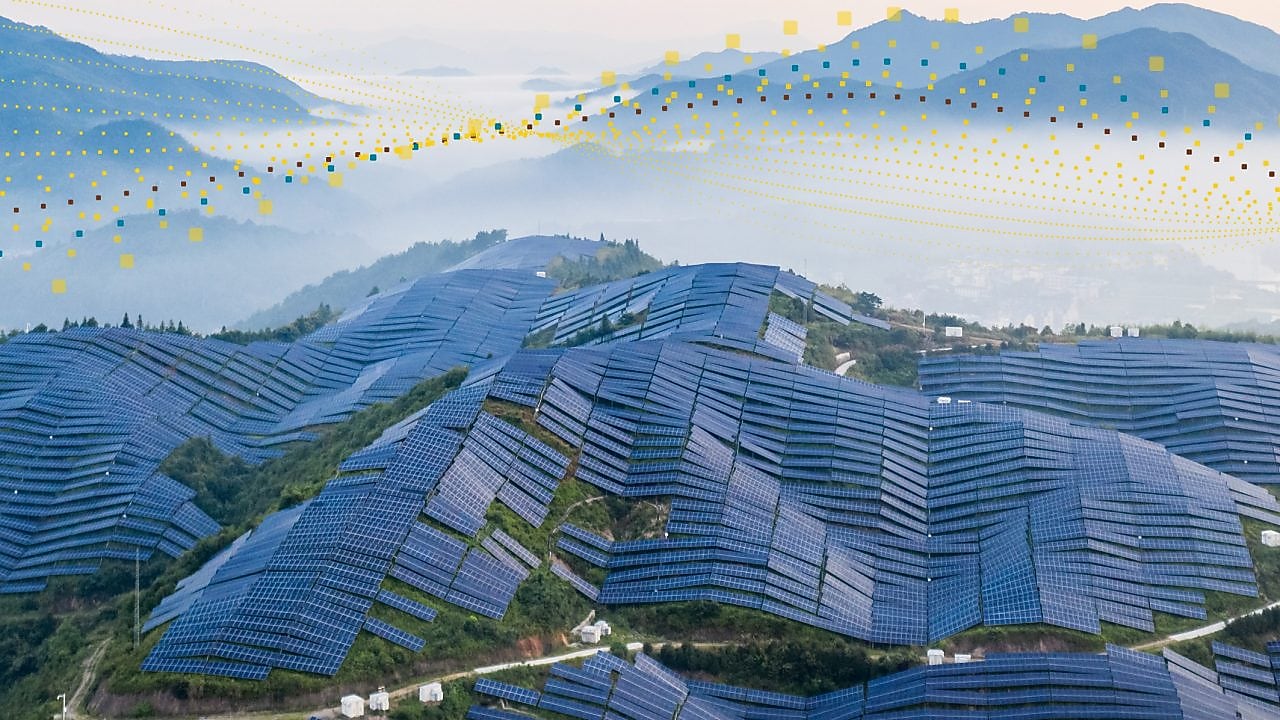

Brasil: liderando o mundo rumo à neutralidade de emissões/ Brazil: Leading the world to net-zero emissions

O Cenários da Shell 2024 indica que o Brasil pode se tornar um dos primeiros países a alcançar a neutralidade de carbono, já em 2040. Dois cenários foram desenhados, a partir dos Cenários de Segurança Energética: o Sky 2050 retrata uma transição mais rápida, mas desafiadora, em que o Brasil e o mundo alcançam a neutralidade de emissões em 2050, enquanto o Arquipélagos destaca os contratempos que podemos enfrentar na busca por limitar o aquecimento global a 1,5º C. Em ambos os cenários, o estudo mostra que o Brasil se destaca entre as principais economias globais, tanto pelo potencial de liderança na transição para uma economia de baixo carbono, quanto como um importante supridor de energia para um mundo que demanda segurança e diversidade. Para isso, são necessárias decisões rápidas e estratégicas e políticas estáveis e previsíveis, que considerem as oportunidades e ameaças comerciais decorrentes de um mundo em busca de produtos e serviços de baixo carbono, mas que continue reconhecendo o valor dos recursos atuais.

Brasil: liderando o mundo rumo à neutralidade de emissões

Brazil: Leading the world to net-zero emissions

Disclaimer

Disclaimer

WARNING - UNCERTAINTIES AHEAD: Brazil: Leading the world to net-zero emissions.

Shell’s scenarios are not intended to be projections or forecasts of the future. Shell’s scenarios, including the scenarios contained in this content, are not Shell’s strategy or business plan. They are designed to stretch management to consider even events that may only be remotely possible. Scenarios, therefore, are not intended to be predictions of likely future events or outcomes and investors should not rely on them when making an investment decision with regard to Shell plc securities. When developing Shell’s strategy, our scenarios are one of many variables that we consider. Ultimately, whether society meets its goal to decarbonise is not within Shell’s control; only governments can create the framework necessary for society to meet the goal of the Paris Agreement. The Sky 2050 scenario is a normative scenario, which means we assume that society meets the most ambitious goal of the Paris agreement: limiting the increase in global average temperatures to 1.5°C above pre-industrial levels this century and then we work back in presenting how this may occur. Our assumptions for the Sky 2050 are based on what we believe are technically possible as of today and not necessarily plausible. Our Archipelagos scenario is an explorative scenario, which means we do not assume the final outcome rather we use plausible assumptions based on the data to determine what we believe will occur in the future. Of course, there is a range of possible paths in detail that society could take to achieve this goal. Although achieving the goal of the Paris Agreement and the future depicted in Sky 2050 while maintaining a growing global economy will be extremely challenging, today there is still a technically possible pathway to accomplish it. However, we believe the window for success is quickly closing.

The companies in which Shell plc directly and indirectly owns investments are separate legal entities. In this content “Shell”, “Shell Group” and “Group” are sometimes used for convenience where references are made to Shell plc and its subsidiaries in general. Likewise, the words “we”, “us” and “our” are also used to refer to Shell plc and its subsidiaries in general or to those who work for them. These terms are also used where no useful purpose is served by identifying the particular entity or entities. ‘‘Subsidiaries’’, “Shell subsidiaries” and “Shell companies” as used in this content refer to entities over which Shell plc either directly or indirectly has control. The term “joint venture”, “joint operations”, “joint arrangements”, and “associates” may also be used to refer to a commercial arrangement in which Shell has a direct or indirect ownership interest with one or more parties. The term “Shell interest” is used for convenience to indicate the direct and/or indirect ownership interest held by Shell in an entity or unincorporated joint arrangement, after exclusion of all third-party interest.

Forward-Looking Statements

This content contains forward-looking statements (within the meaning of the U.S. Private Securities Litigation Reform Act of 1995) concerning the financial condition, results of operations and businesses of Shell. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements are statements of future expectations that are based on management’s current expectations and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in these statements. Forward-looking statements include, among other things, statements concerning the potential exposure of Shell to market risks and statements expressing management’s expectations, beliefs, estimates, forecasts, projections and assumptions. These forward-looking statements are identified by their use of terms and phrases such as “aim”; “ambition”; ‘‘anticipate’’; ‘‘believe’’; “commit”; “commitment”; ‘‘could’’; ‘‘estimate’’; ‘‘expect’’; ‘‘goals’’; ‘‘intend’’; ‘‘may’’; “milestones”; ‘‘objectives’’; ‘‘outlook’’; ‘‘plan’’; ‘‘probably’’; ‘‘project’’; ‘‘risks’’; “schedule”; ‘‘seek’’; ‘‘should’’; ‘‘target’’; ‘‘will’’; “would” and similar terms and phrases. There are a number of factors that could affect the future operations of Shell and could cause those results to differ materially from those expressed in the forward-looking statements included in this content , including (without limitation): (a) price fluctuations in crude oil and natural gas; (b) changes in demand for Shell’s products; (c) currency fluctuations; (d) drilling and production results; (e) reserves estimates; (f) loss of market share and industry competition; (g) environmental and physical risks; (h) risks associated with the identification of suitable potential acquisition properties and targets, and successful negotiation and completion of such transactions; (i) the risk of doing business in developing countries and countries subject to international sanctions; (j) legislative, judicial, fiscal and regulatory developments including regulatory measures addressing climate change; (k) economic and financial market conditions in various countries and regions; (l) political risks, including the risks of expropriation and renegotiation of the terms of contracts with governmental entities, delays or advancements in the approval of projects and delays in the reimbursement for shared costs; (m) risks associated with the impact of pandemics, such as the COVID-19 (coronavirus) outbreak, regional conflicts, such as the Russia-Ukraine war, and a significant cybersecurity breach; and (n) changes in trading conditions. No assurance is provided that future dividend payments will match or exceed previous dividend payments. All forward-looking statements contained in this content are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Readers should not place undue reliance on forward-looking statements. Additional risk factors that may affect future results are contained in Shell plc’s Form 20-F for the year ended December 31, 2023 (available at www.shell.com/investors/news-and-filings/sec-filings.html and www.sec.gov). These risk factors also expressly qualify all forward-looking statements contained in this content and should be considered by the reader. Each forward-looking statement speaks only as of the date of this content June 20, 2024. Neither Shell plc nor any of its subsidiaries undertake any obligation to publicly update or revise any forward-looking statement as a result of new information, future events or other information. In light of these risks, results could differ materially from those stated, implied or inferred from the forward-looking statements contained in this content .

The contents of websites referred to in this content do not form part of this content .

We may have used certain terms, such as resources, in this content that the United States Securities and Exchange Commission (SEC) strictly prohibits us from including in our filings with the SEC. Investors are urged to consider closely the disclosure in our Form 20-F, File No 1-32575, available on the SEC website www.sec.gov.